Sharia is a set of Islamic religious laws governing various aspects of the day-to-day life of Muslims. One of the aspects of the Sharia law is the prohibition of charging interest on loans. It is considered as an unfair practice.

Most Islamic countries adopt the Sharia law either fully or partially into their legal system. In countries that impose this law, banks adopt a different method of operation that allows them to have a similar effect as charging interest, but without violating the Sharia law.

Here’s how it works:

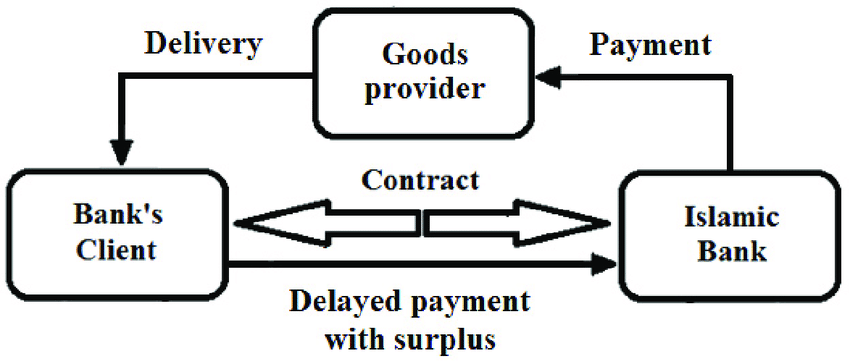

Let’s say you want to buy a house and you ask a bank in Saudi Arabia for a housing loan of 1 million Saudi Riyal(SAR). Instead of giving you the loan amount, the bank will first buy the house for 1 million SAR and sell it to you for 1.1 million SAR or some other higher amount. You will then pay this 1.1 million SAR in monthly installments to the bank over a period of a few years.

As you see, the concept of interest is never used in the whole process, yet it has similar effects. This method is called Murabaha (Cost-Plus Financing). Instead of charging interest, the bank sells something to you for profit, which is allowed under Sharia law.

What if you want a Personal Loan?

They follow a similar method for personal loans too. The bank buys a commodity like gold or silver at market price and sells it to you for a higher price. You convert it into cash by selling it in the market and you pay back the higher price to the bank in monthly installments. This method is called Tawarruq (Commodity Murabaha).

Truly Interest-Free

There are also some Islamic banks which provide interest-free loans without any profit. You just pay back the same amount you borrowed. This kind of loan is limited and is provided on a goodwill basis only for charitable purposes or to help individuals in need. There is no commodity involved here. This is called Qard Hasan (Benevolent Loan)

Is it fair to charge interest?

Sharia law prohibits interest on loans because it considers it an unfair transaction. However, from a different perspective, charging interest can be seen as fair if the interest rate is reasonable considering the inflation rate, the time value of money, and the risk the lender takes. So fairness ultimately depends on the rate of interest and the context in which it is applied.

https://www.investopedia.com/terms/i/islamicbanking.asp

https://www.econlib.org/library/Enc/InterestRates.html

https://en.wikipedia.org/wiki/Islamic_banking_and_finance