When the coronavirus pandemic hit, many countries went into lockdown. People stayed home to stop the virus from spreading. This also meant businesses had to close. With shops, restaurants, and factories shut, the economy started to slow down. To help fix this problem, governments around the world decided to print more money. How does printing more money solve this problem?

Liquidity Injection

Printing more money is often called a “liquidity injection.” This is because it adds more liquid cash into the economy. It’s like pouring more water into a stagnant drainage so that it keeps flowing. Similarly, when money becomes stagnant in people’s accounts, everything slows down. People stop buying things, businesses stop making money, and workers lose their jobs. By injecting more money, the government tries to keep everything moving.

How Liquidity Injection Helps

- Encourages Spending: Some of the printed money goes directly to people’s accounts. When people have more money, they are more likely to spend it. This helps businesses that are struggling during the lockdown. For example, if you get some extra money, you might buy more groceries, clothes, or even gadgets. This spending helps shops and companies make money, which in turn helps them pay their workers.

- Supports Businesses: Some of the money goes to businesses. This helps them keep paying their workers and stay open, even if they don’t have many customers during the lockdown. It’s like giving a lifeline to businesses so they can survive tough times.

- Boosts Confidence: Knowing that the government is taking action can make people feel more confident about the future. This confidence can make them more likely to spend money and keep the economy going.

Why We Can’t Keep Printing Money

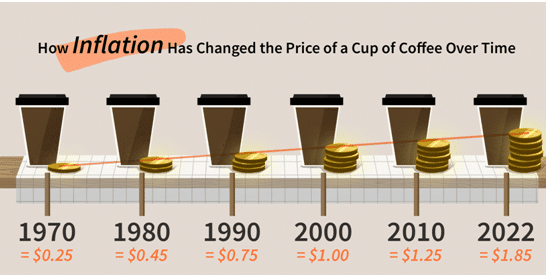

If printing money helps, why don’t we just print a lot of it and make everyone rich? The problem is that printing too much money can lead to inflation. Inflation is when prices for goods and services go up. If there’s too much money in the economy, the value of money goes down. It’s like having a lot of something that nobody wants; it becomes less valuable.

Imagine if everyone suddenly had twice as much money. People might start buying more things, but there wouldn’t be more things to buy. So, sellers would raise prices because they know people have more money. Soon, everything becomes more expensive, and the extra money doesn’t help as much as it seemed at first.

How Central Banks Control Money

Central banks, like the Federal Reserve in the United States or the European Central Bank in Europe, are in charge of managing the money supply. They have several tools to do this. One of them is managing the interest rates. Central banks can change interest rates to control how much money is in the economy. Lower interest rates make borrowing money cheaper, so people and businesses are more likely to take loans and spend. Higher interest rates make borrowing more expensive, so people and businesses spend less. They also have a few other ways to control the money supply.

The Balance

Finding the right balance is tricky. Governments and central banks need to inject enough money to keep the economy moving, but not so much that it causes runaway inflation. During the corona lockdown, the challenge was even bigger because the situation was so unusual.

Printing more money was a way for governments to keep the economy from collapsing. But it’s not a simple fix, and it’s important to manage the money supply carefully to avoid problems like inflation.

Reference Links:

https://en.wikipedia.org/wiki/Money_creation

https://www.investopedia.com/articles/investing/053115/how-central-banks-control-supply-money.asp